About Retirement Home Living

Retirement homes are a great option for those seniors who do not have a need for a larger home, but who still want to maintain an independent space. In retirement homes, seniors have access to their own private rooms or a suite of rooms maintained within a larger space. They typically share other facilities such as dining quarters, social areas, and even spaces such as beauty salons in the facility with other individuals. Retirement homes typically offer a lower level of medical care and greater independence for seniors than facilities such as nursing homes. However, many retirement homes may help facilitate medical appointments, transportation, and other essential services.

Top Cities for Retirement Homes in the US

- Miami, FL

- Los Angeles, CA

- San Jose, CA

- Philadelphia, PA

- Seattle, WA

- Portland, OR

- Denver, CO

- San Francisco, CA

- St Louis, MO

- Houston, TX

- San Diego, CA

- Phoenix, AZ

- Indianapolis, IN

- Columbia, SC

- Fort Lauderdale, FL

- Pittsburgh, PA

- San Antonio, TX

- Sacramento, CA

- Las Vegas, NV

- Hialeah, FL

- Dallas, TX

- Cincinnati, OH

- Tampa, FL

- Atlanta, GA

- Oklahoma City, OK

- Tucson, AZ

- St Petersburg, FL

- Spokane, WA

- Colorado Springs, CO

- Mesa, AZ

More About Retirement Home Living

Retirement homes are a great option for seniors who no longer need a large home, but still want to maintain an independent space with access to amenities. Seniors have their own private rooms or a suite of rooms within a larger space. They typically share other facilities such as dining quarters and social areas.

What is a Retirement Home or Retirement Community?

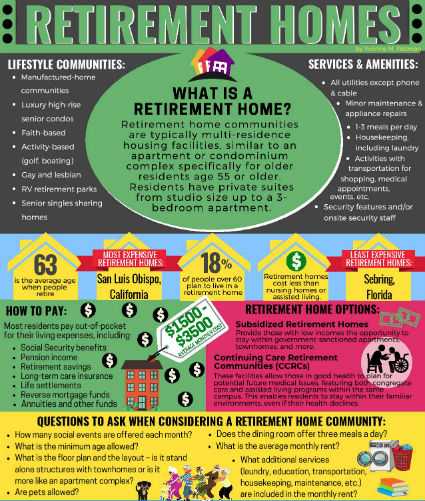

Retirement home communities, sometimes referred to as independent living, are typically multi-residence housing facilities, similar to an apartment or condominium complex. Residents have private suites from studio size up to a one-bedroom apartment. They can be rented or purchased. Depending on the retirement home, there are a variety of service offerings such as meals, social groups, recreational activities, and transportation.

Most retirement communities provide onsite security and access to maintenance and housekeeping services. A retirement home is an attractive option for seniors wishing to live independently and to reduce typical homeowner responsibilities. Residents of independent living units may have some in-home health care-type services provided to them by an outside agency. Each facility's services may vary, so it is important to do research and ask questions.

When to Consider a Retirement Home

Here are four key areas to think about as you're evaluating whether to move to a retirement community.

- Transportation - Do you plan to continue driving? What are the options in your area if you need to stop driving at some point?

- Finances - Do you have the income to cover your needs, including in-home care, if it becomes necessary?

- Health care - Do you live near the doctors and a hospital? How could you handle a medical problem on the weekend or on a holiday?

- Household maintenance - Which tasks can you still handle, and which do you need help with? Who is available - volunteer or professional - to help?

Types of Retirement Homes

Do you want to live in a single family home or apartment? Perhaps you'd like or share a home with other single seniors? There's a place for every senior.

55+ Communities

Age-restricted communities let seniors buy or rent housing on properties with shared amenities and services such as golf courses, swimming pools and transportation. Each residence is typically connected to the others by sidewalks or other paths. Residents of age-restricted communities have many opportunities to socialize informally and through planned activities. Generally, a clubhouse serves as the community center with areas for restaurant-style dining and recreational activities.

Senior Apartments

Senior apartments might be referred to numerous ways: 55+ apartments, 62+ apartments, age-restricted apartments, or active adult apartments. Benefits of senior apartments include planned activities such as exercise classes, movie nights, card game parties, and local day-trips. They also typically have extra security measures such as cameras and emergency alert systems. Some also have security-patrolled grounds and even security guards posted at entryways. The biggest difference from senior communities is that they generally do not include meals and housekeeping as part of your rent.

Senior Co-housing

In a cohousing community, residents live privately in condos or attached homes, but share certain properties or amenities with other residents. The main idea behind cohousing (and the biggest advantage) is that it balances privacy with a community atmosphere. Through the sharing of food, energy, maintenance upkeep costs, and other expenses, residents of cohousing communities can save hundreds or even thousands of dollars over what they would pay for comparable senior living arrangements elsewhere.

Lifestyle Communities

Seniors may want to choose their community based on specific interests, beliefs, affinity groups, or a type of lifestyle. Choices include:

- Veterans retirement communities

- University-affiliated retirement communities

- LGBT retirement communities

- Faith-based retirement communities

- Golf retirement communities

- Boating retirement communities

- Recreational Vehicle (RV) retirement communities

Retirement Home vs. Home Care

Preference and cost are determining factors when choosing between retirement home living and home care. For seniors who are very attached to their living environment and have the funds to hire home care for housekeeping, yard work and repairs, it makes sense to stay in their home. However, if the weight and expense of managing a household is becoming too much, a retirement community might work better. It's typically a smaller, more manageable apartment and home care services can be provided in their new space.

Retirement Home vs. CCRCs

For seniors who want to ensure that they don't have to move again, Continuing Care Retirement Communities (CCRCs) offer a combination of independent living apartments, assisted living units and skilled nursing care rooms all available on one campus. CCRC residents can transition to other areas within the community that will serve their increasing care needs. CCRCs have evolved over the past several years and offer enticing service packages and entrance-fee options. Providing 24-hour staff and security, gourmet meals, religious, social and leisure activities, housekeeping, laundry, transportation, wellness and fitness programs, CCRCs are an attractive all-inclusive housing option for seniors.

Retirement Home vs. Assisted Living

The difference between a retirement community and an assisted living facility are the services that are provided. Those living in retirement centers have access to help with meals and housekeeping/maintenance tasks, as well as services focused on recreation and group activities. Assisted Living centers have a more hands-on approach and typically have staff onsite 24/7 to help aging adults with activities of daily living, such as grooming, bathing, dressing, medication reminders, laundry and other personal services. At least one medical professional (typically a certified nurse practitioner), is always available in most assisted living residences.

How Much Do Retirement Homes Cost?

A retirement home costs less than assisted living or a nursing home. However, for seniors who are on a fixed income, most retirement communities require a one-time lump sum in addition to the monthly rent. This ranges from $100,000 to $500,000 at modest senior retirement communities. On top of this, a senior will be responsible for paying a monthly fee that covers services, such as food, housekeeping, and activities. If this is not possible, you'll need to look for low-income senior housing. This is provided via the US Department of Housing and Urban Development or HUD through your local Department of Family and Human Services.

The monthly fees for a retirement community vary mainly due to size and location, with the average cost ranging from $1,500 to $3,500 per month. Like any long-term-care option, the costs and options associated with a retirement home vary by area - it is important to explore each facility, ask questions and read over agreements carefully to be sure the community offers what is desired.

Rent and utilities represent the primary cost for independent living residents. Aging adults who live in communities that offer specialized recreational opportunities like private golf courses may incur additional expenses in the form of membership and/or joining fees. Different meal plans are usually available for on-site dining, and additional costs may be involved depending on the mix of services and add-ons chosen.

How Can I Pay For a Retirement Home?

Retirement communities don't provide residents with medical services. Therefore, Medicare, Medicaid, and other financial aid programs won't cover the cost. Instead, seniors must pay privately, using funds from Social Security benefits, pension income, retirement savings, life settlements, reverse mortgage funds, annuities and other personal funds.

Social Security and Pensions

Seniors receiving Social Security and other types of pensions can use those funds cover retirement-related living expenses, including payments made to reside in retirement home. This contrasts with Medicare and Medicaid, which are more geared towards the payment of an elder's health care costs, or a low-income senior's medical and housing expenses, respectively.

Government Programs

The U.S. Department of Housing and Urban Development (HUD) offers help paying for both independent and assisted living to eligible low-income seniors through the Housing Choice Voucher (formerly Section 8) and Section 202 programs. However, due to high demand for these programs, the waiting lists are often very long.

Long-Term Care Insurance

Benefits vary from policy to policy, but some forms of long-term care insurance will cover retirement community costs. Before signing up for a policy, make sure you clearly understand what it will and won't pay for, including which senior housing categories (e.g. assisted living, in-home care, skilled nursing) are and are not included.

Life Insurance

These options greatly depend on the type of life insurance policy so it's best to discuss with an insurance broker or financial advisor.

- Life Settlement - You can sell your life insurance policy to a third party for market value and use the proceeds to fund retirement community costs.

- Surrender Policy - You give up ownership and the death benefit. If the policy has accumulated cash, the insurance company writes you a check for the full amount of cash value, which is often taxed.

- Policy Loan - You can take a loan from your life insurance policy, which means you won't pay taxes. However, you can't take it all or the policy will lapse.

- 1035 transaction - This allows you to exchange cash value from an existing life insurance policy into a new life insurance policy with long-term care insurance benefits tax-free.

Reverse Mortgage Loans

The Home Equity Conversion Mortgage (HECM) is a reverse mortgage that seniors take against their home's equity. Insured by the federal government, it is only accessible via lenders approved by the Federal Housing Administration (FHA). Once finalized, the lender makes payments in a single lump sum, monthly installments, or as a line of credit. The loan does not have to be paid back until the last borrower passes away or moves from the home for one full year. The home is usually sold, and the lender is paid back the full loan amount plus interest.

Private Funding

In situations when costs aren't covered through other means, paying via private funds is an option. Sources of private funds for assisted living include retirement accounts and 401Ks, savings accounts, annuities and insurance plans (including life settlements), trusts and stock market investments. Home equity and bridge loans can also be used when transitioning to an retirement community.

Evaluating Retirement Homes

As you begin to tour retirement communities, keep a list of standard questions so you can compare answers across all your contenders. Here are some questions to give you starting point:

- Do you want to live in a communal setting? What's your personality? If you've lived in your own home for about 50 years, moving to an apartment-style complex will certainly require an adjustment.

- Are meals provided? Most retirement communities provide one or two meals a day, with kitchens available if you'd rather cook. It should go without saying that you should try the food! Ask about the meal hours, seating, and dietary restrictions.

- What entertainment or activities are provided? Make sure they suit your interests, aren't a huge added cost, and are accessible for you if you have mobility issues.

- What kind of transportation do they offer? Most have transportation, but within certain limitations. Will you feel like you have the freedom you need?

- What kind of people live there? Find out the ratio of men to women and singles versus couples so you can decide based on your preferences. Take every opportunity to talk with current residents to get a feel for the community.

- What amenities are included and what costs extra? Find out if they charge a flat amount or services a la carte. Make sure you aren't nickel and dimed and get everything in writing.

- What kind of personal assistance is offered? Some retirement communities will provide personal home care for a fee using their services, and others let you choose an external agency. If you need significantly more care, will that mean you need to leave the community, or do they have assisted living on the same campus?

- What are the contract details? We recommend having your lawyer and/or financial advisor review the document. Make sure you understand your rights as a resident, the pricing structure, what's included in the base fee, and how they assess price increases.

Retirement Home Regulations

Since retirement homes do not provide healthcare services, they are not subject to the same rules and regulations governing long-term care facility operations. However, many of these communities do serve food, so they are likely inspected by local health departments. They would also be inspected for compliance for fire code compliance. Asking to review these records can tell you whether the community follows required state and federal regulations.

Additional Retirement Home Resources

- What is a Retirement Home?

- Tips For Seniors Looking to Buy into Retirement Communities

- Keeping Seniors Independent While in Retirement Homes

- The Advantages of Retirement Homes

Top Articles in Retirement Homes

View All

Keeping Seniors Independent While in Retirement Homes

Moving to a retirement home can be a challenging and at times overwhelming transitional time for seniors. However, even for seniors who are enthusiastic about life in retirement homes, many feel as though life in one of these communities can cause a detriment to their independence. This is why it is...More

Read More

Tips For Seniors Looking to Buy into Retirement Communities

When it comes to senior living options, there are a number of housing options available for today's elderly population. While some seniors will require the care and attention of nursing homes or assisted living communities, there are others who don't require as much care, but who instead want to be ...More

Read More

What is a Retirement Home?

In an industrial-driven society, retirement often proves more fantasy than reality. Thoughts rarely stray from the 9 to 5 immediacy, and preparing for the future seems impossible. People must work to live and live to work. However, the day eventually comes for every man and woman to give a final ...More

Read More

Your Information is Processing

Your Information is Processing